Blog Layout

IRS Guidance on 20% Business Income Deduction

LOUISIANA REALTORS • August 9, 2018

The Internal Revenue Service issued proposed regulations for a new provision allowing many owners of sole proprietorships, partnerships, trusts and S corporations to deduct 20 percent of their qualified business income. The new qualified business income deduction is available for tax years beginning after Dec. 31, 2017. Taxpayers can claim it for the first time on the 2018 federal income tax return they file next year.

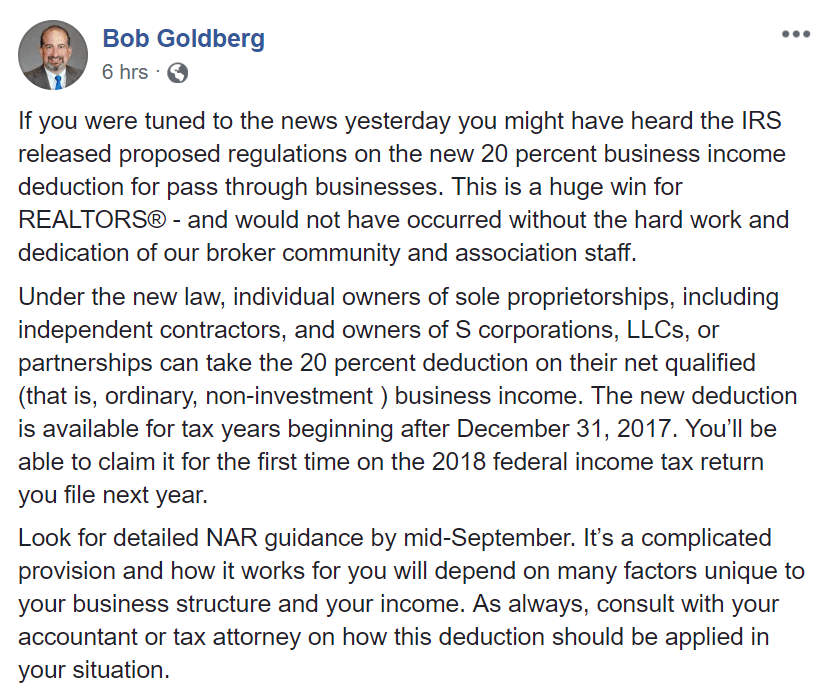

The deduction will have a significant, beneficial impact on NAR’s membership. The National Association of Realtors® believes that this deduction, included in today’s IRS and Treasury Department release of proposed regulations, will be available to a wide range of real estate professionals, including those who are self-employed as well as those operating through partnerships, LLCs, and S corporations. Here is what Bob Goldberg, NAR CEO had to say about it:

Share

Tweet

Share

Mail

About Us

All rights reserved.

Useful Links

Contact Info

821 Main StreetBaton Rouge, LA 70802

821 Main Street

Baton Rouge, LA 70802

Subscribe to Our Newsletter

Subscribe to newsletter

Thank you for subscribing to our newsletter.

Oops, there was an error sending your message.

Please try again later.

Please try again later.