Changes to NFIP Policies Coming Oct 1

What REALTORS® Need to Know About Risk Rating 2.0

On October 1, 2021, FEMA will implement a new pricing system for National Flood Insurance Program (NFIP) policies called Risk Rating 2.0. This new pricing methodology comes just as the latest NFIP extension expires on September 30th . Expirations of NFIP extensions are something Louisiana citizens are all too familiar with, but the implementation of Risk Rating 2.0 will bring many changes to how NFIP flood policies are priced.

Louisiana REALTORS® encourages REALTORS® and their clients to contact their insurance companies to determine what their new NFIP rates will be under Risk Rating 2.0. Many property owners are finding that their flood insurance rates will increase significantly under Risk Rating 2.0 while others are finding that their rates will remain relatively the same. Agents should also have discussions with their clients about sellers assigning their flood insurance policies to buyers so buyers can take advantage of any premium discounts a seller currently has (currently known as grandfathering).

New NFIP policies, will be subject to the new pricing methodology. Existing policyholders eligible for renewal will be able to take advantage of any immediate decreases in their premiums. All remaining policies renewing on or after April 1, 2022, will be subject to the new pricing system.

REALTOR® members can be assured that Louisiana’s congressional delegation is leading the way to address both these matters. Senators Cassidy and Kennedy, along with other co-authors, introduced legislation to extend the NFIP program through September 30, 2022. And, Congressmen Scalise and Graves officially urged FEMA to delay the implementation of Risk Rating 2.0, however there has been no indication to date that Risk Rating 2.0 will be deferred. View the full letter here.

REALTORS® and their clients should reach out to their trusted insurance partners to learn how these changes will affect their individual NFIP policies so informed decisions can be made going forward. Addtional information about Risk Rating 2.0 can be found here.

As part of an educational partnership with FEMA, Louisiana REALTORS® hosted a session "Flood Map Changes: What They Mean & What You Should Recommend" in August to highlight and explain the changes with addtional sessions scheduled throughout the remainder of the year. Panelists included Darrin Dutton, Rebecca Dake and Alan Johnson with FEMA Region 6 along with Pam Lightfoot with LADOTD Floodplain Office.

Handouts and a full recording are available for further viewing along with additional information.

The National Association of REALTORS hosted a Town Hall meeting with FEMA Senior Executive David Maurstad providing an update on the new flood insurance pricing system of Risk Rating 2.0.

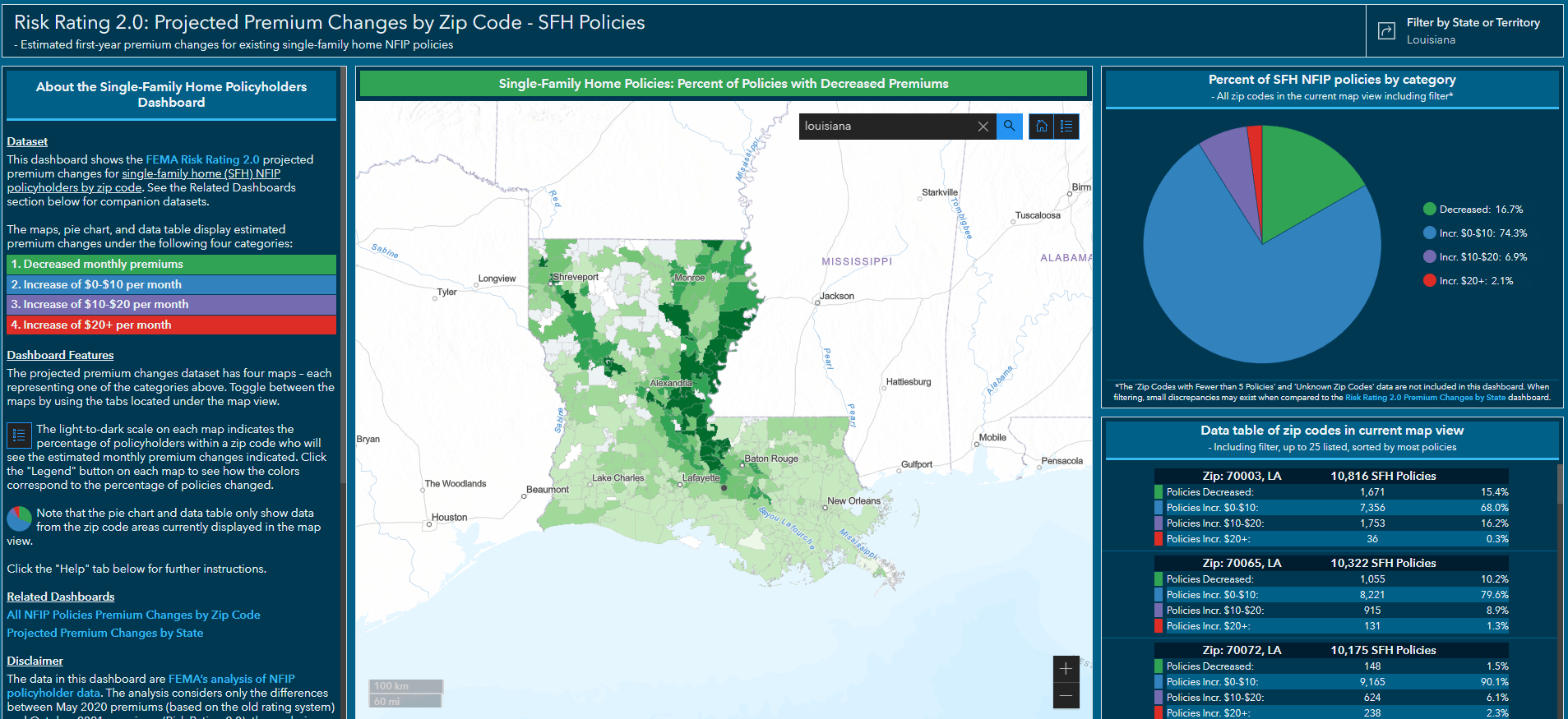

Risk Rating 2.0: Projected Premium Changes by Zip Code

This dashboard shows the FEMA Risk Rating 2.0 projected premium changes for single-family home (SFH) NFIP policyholders by zip code. The projected premium changes dataset has four maps – each representing one of the categories.

- Decreased monthly premiums

- Increase of $0-$10 per month

- Increase of $10-$20 per month

- Increased of $20+ per month

Disclaimer

The data in this dashboard are FEMA’s analysis of NFIP policyholder data. The analysis considers only the differences between May 2020 premiums (based on the old rating system) and October 2021 premiums (Risk Rating 2.0); the analysis does not consider typical premium increases that might have occurred without Risk Rating 2.0.

The maps generated do not reflect the total amount of premium changes or the overall cost of premiums paid. Nor do the maps provide information regarding any property’s unique flood risk. In compliance with data privacy policies, data in zip codes with less than five policyholders have not been released by FEMA. The number of policies and associated rate changes across all of these areas are available only in the aggregate